reit dividend tax south africa

A fundamental part of the regime relates to the ability of the REIT and its subsidiaries to deduct for income tax purposes dividends declared and paid to their immediate shareholders. To qualify for the South African REIT dispensation a the REIT either a company or a trust must be tax resident in South Africa and be listed as an REIT in terms of the JSE Johannesburg Stock Exchange listing requirements.

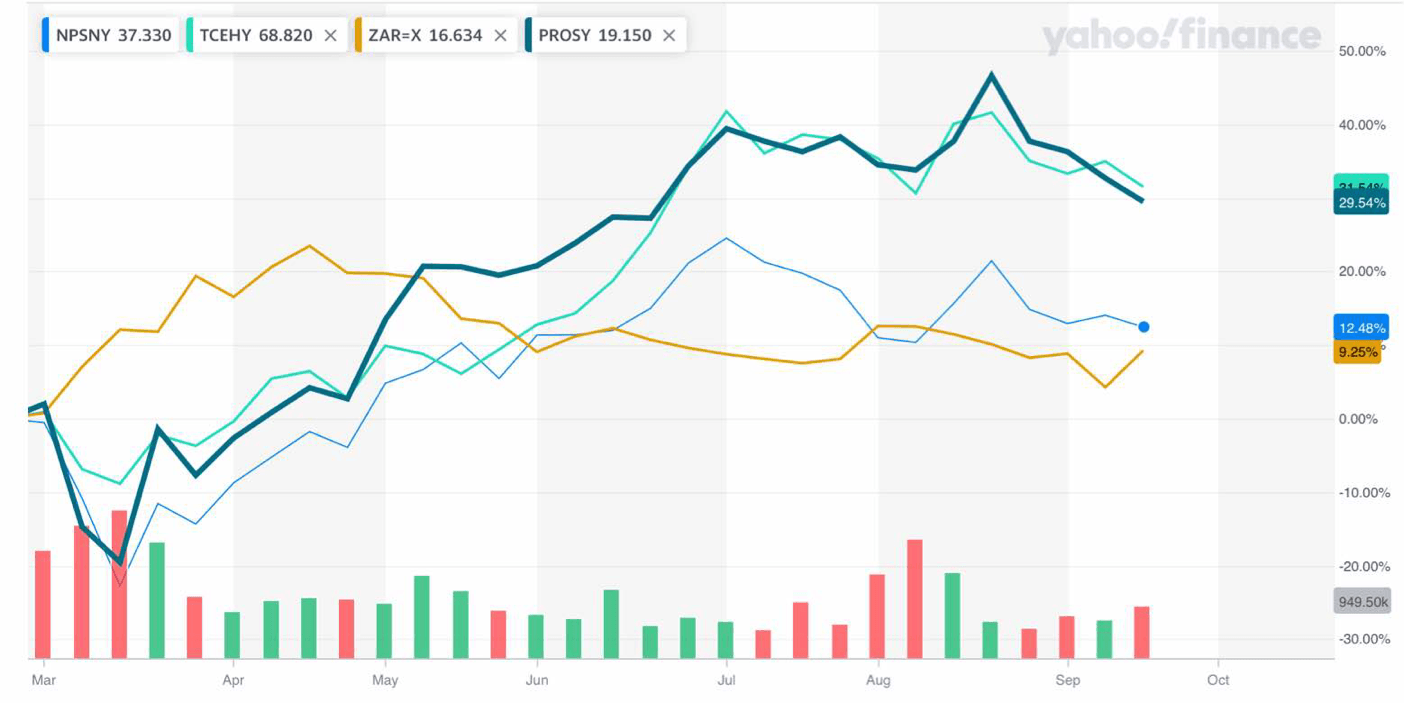

Buy Naspers Because The Discount Won T Close Otcmkts Naprf Seeking Alpha

Dividends received from REITs are not exempt from income tax.

. SP Dow Jones. REIT Dividends - South African tax resident shareholders. Until recently the definition of a REIT in the Income Tax Act No 58 of 1962 Act referred to a company that is a South African tax resident whose shares are listed on the JSE as shares in a REIT as defined in the JSE Limited Listing Requirements.

Cape Town South Africa Site secured by Comodo Security. This took the form of a new section section 25BB in the Income Tax Act. Dividend tax withheld at 20 Distribution to investors21 Tax on investors taxable incomeLl Net return for the individual investors all REIT RI 00000 RIOOOOO RIOOOOO R45OOO R55OOO.

March 2 2015. The distributions received by or accrued to South African tax residents must be included in the gross income of. Instead the shareholder pays.

Section 25BB of the Income Tax Act was adopted in South Africa with effect from 1 April 2013 to govern the taxation of real estate investment trusts REITs. REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt from income tax in terms of the exclusion to the general dividend exemption contained in paragraph aa of section 101ki of the Income Tax Act because they are. The SP South Africa REIT Index is designed to measure the performance of publicly traded real estate investment trusts SA-REIT or Property Unit.

Real estate investment trusts REITs are subject to a special tax regime in South Africa. Interest earned by non-residents who are physically absent from South Africa for at least 182 days 2021 2020 it was 183 days during the 12 month period before the interest accrues and. Posted 2 August 2015 Peter says.

Treasury formally published the REIT tax legislation for South Africa on 25 October. In order to be tax deductible any such dividend must meet the. Dividends received by a South African taxpayer are generally exempt from income tax.

The REIT regime in South Africa aims to create a flow though vehicle for income tax purposes. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets. The rate of Dividends Tax increased from 15 to 20 for any dividend paid on or after 22 February 2017 irrespective of declaration date unless an exemption or reduced rate is applicable.

Index News Dec 31 2021. REITs - the reduced corporate income tax rate Author. SP Dow Jones Indices Announces Change in Dividend Withholding Tax Rate SP Dow Jones Indices Announces Change in Dividend Withholding Tax Rate.

Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation DTA between South. Dividends received by individuals from South African companies are generally exempt from income tax but dividends tax at a rate of 20 is withheld by the entities paying the dividends to the individuals. As of 1 January 2014 the SA dividend withholding tax at 15 or the treaty governed rate where the investor is.

What is a REIT and how to invest in one. From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a South African source payable to non-residents. As a REIT by its nature distributes most of its net income to its investors the REIT itself usually pays little or no income tax.

A REIT is a company that owns and operates income-producing immovable property. 1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total nett REIT dividends for period R3709. In South Africa a REIT receives special tax considerations and offers investors exposure to real estate through shares listed on the Johannesburg.

The major exemption though being dividends received from so-called REITs these being some of the major property owing companies listed on the JSE such as for example Redefine Properties Ltd. A summary of the withholding tax rates as per the South African Double Taxation Agreements currently in force has been split into two parts Africa and the. Put simply a REIT may deduct for income tax purposes distributions made to its shareholders.

The definition of a REIT in the Income Tax Act refers to a company that is a South African. 2012 in the 2012 Taxation Laws Amendment Bill. How Much Is Dividend Tax In south Africa.

Reit Dividends Tax. The major exemption though being dividends received from so-called REITs these being some of. Dividend holding tax has not been taken off.

Foreign shareholders of SA REITs are levied a dividend withholding post tax at the current rate of 20 but this can be reduced in terms. A REIT is a company that owns and operates income-producing immovable property.

South Africa Reits Investing Offshore International Tax Review

Buy Naspers Because The Discount Won T Close Otcmkts Naprf Seeking Alpha

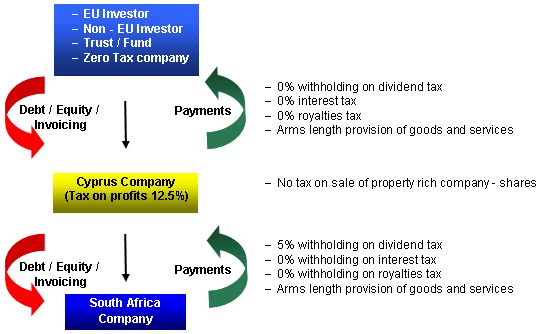

Structuring Investments In From South Africa Through Cyprus Tax Treaties Cyprus

Location Map Of South Africa Mapa Mundi Mapa Republica Democratica Do Congo

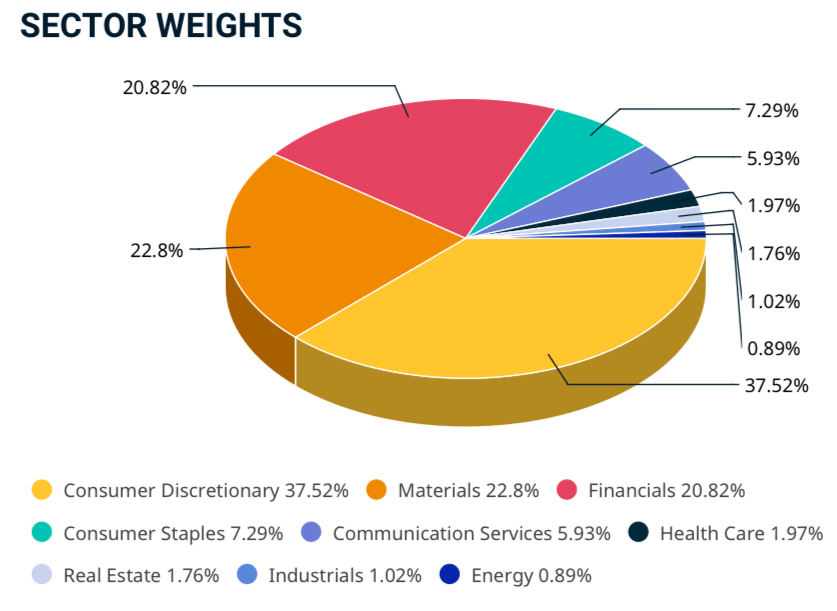

Best Etf South Africa Compare Top Etfs For 2022

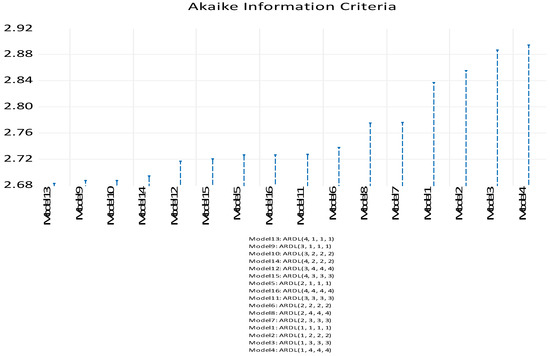

Economies Free Full Text Evaluating The Liquidity Response Of South African Exchange Traded Funds To Country Risk Effects Html

Sa Corporate Real Estate Limited Group Structure

Economies Free Full Text Evaluating The Liquidity Response Of South African Exchange Traded Funds To Country Risk Effects Html

A Closer Look At The South African Property Sector

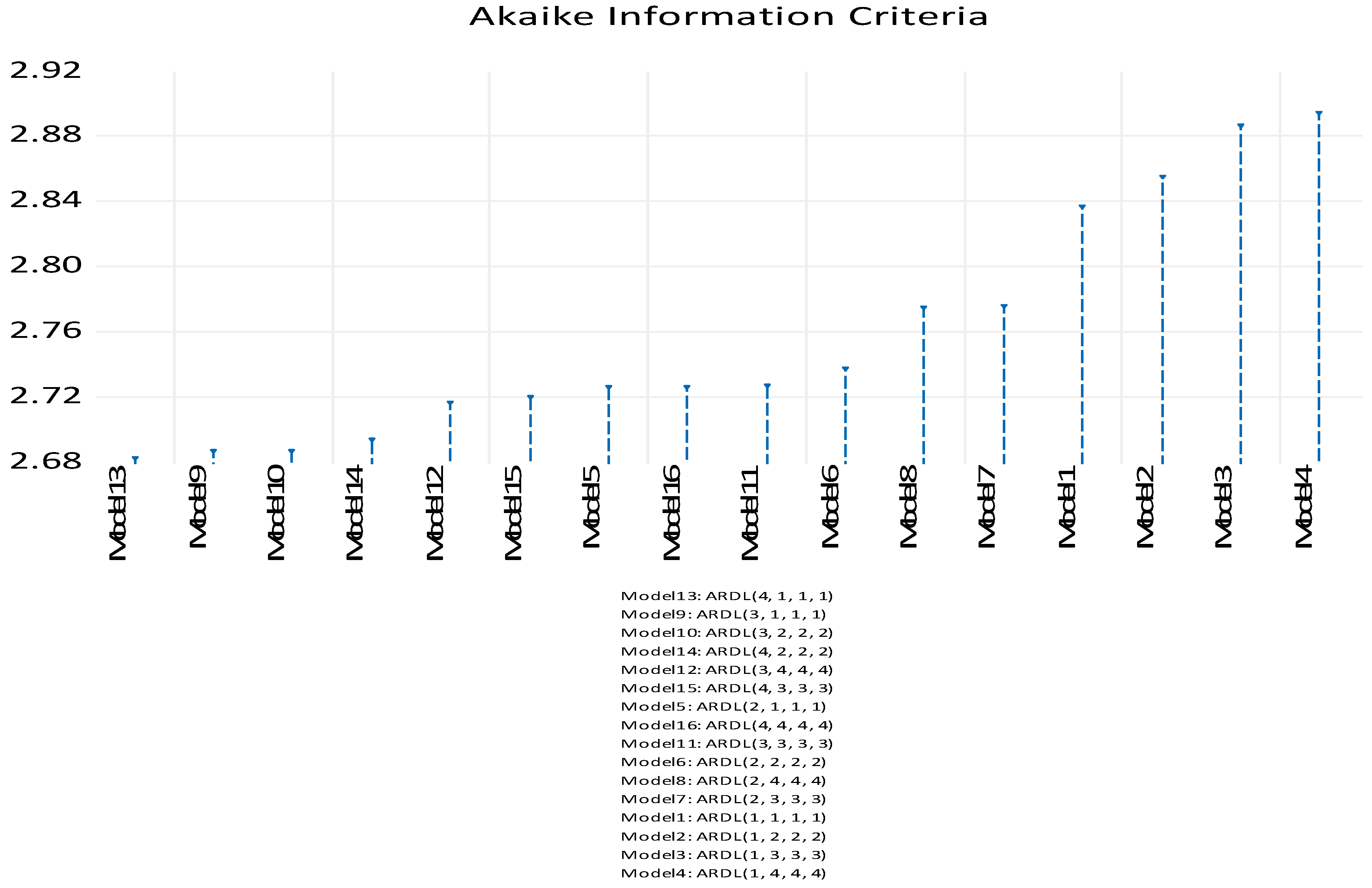

South Africa Nominal Gdp Compression Nightmare Seeking Alpha

How Reit Regimes Are Doing In 2018 Ey Slovakia

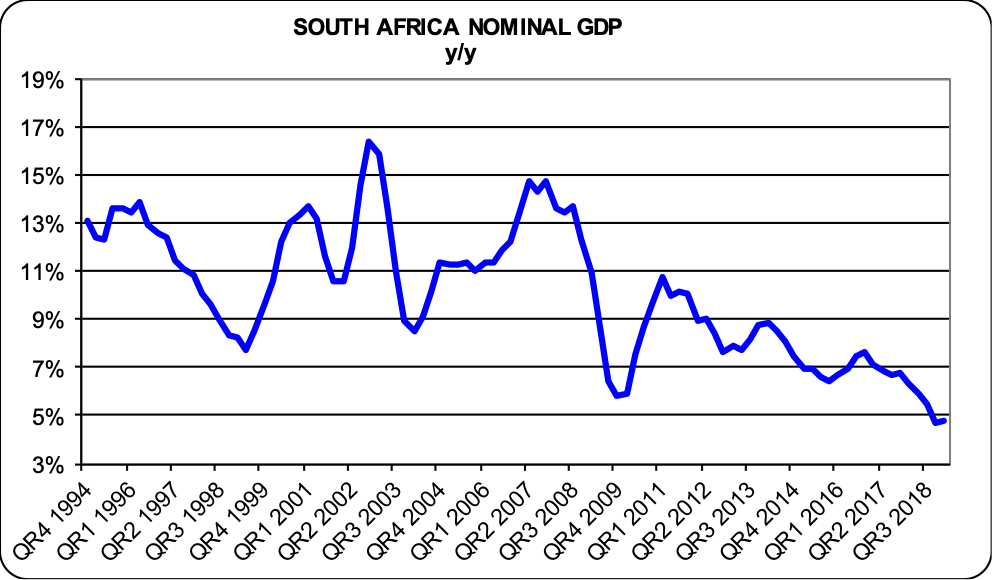

Sa Reits Performance Trends And Outlook Moneyweb

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

Key Infrastructure Projects In South Africa Hit By Delays Bnn Bloomberg

Pdf An Overview Of The Initial Performance Of The South African Reits Market

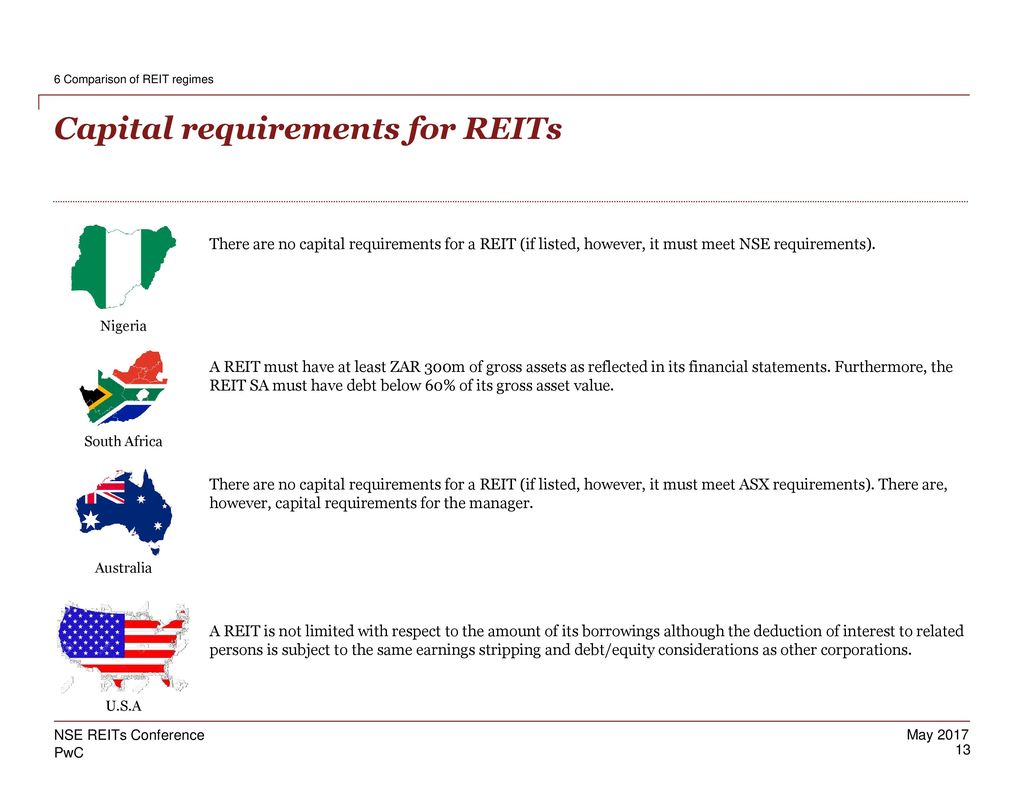

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

Buy Naspers Because The Discount Won T Close Otcmkts Naprf Seeking Alpha